The AI Awakening: How Autonomous Agents Are Rewriting the Rules of Insurance

The insurance industry is standing on the precipice of a revolution, and artificial intelligence is the driving force. By 2026, we’re set to see autonomous AI agents become integral to how insurance operates, fundamentally reshaping everything from how policies are written to how claims are handled. This isn’t just a minor upgrade; it’s a complete reimagining of the entire insurance lifecycle, promising a future that’s faster, smarter, and more tailored to you.

The Inevitable Rise of AI Agents in Insurance

Let’s face it, insurance has often been seen as a bit… well, traditional. But that’s changing, and fast. AI agents are no longer a futuristic concept; they’re rapidly becoming a necessity for insurers looking to stay competitive. As this technology matures, its potential to solve long-standing industry problems and unlock new opportunities is becoming incredibly clear. You’ve probably seen the headlines – AI is making serious waves, and the insurance world is no exception. Keeping an eye on these developments is crucial because they signal a massive shift that will affect insurers, policyholders, and the entire financial services landscape.

Redefining Insurance Operations: Enter AI Autonomy

At its heart, this transformation is about “redefining” insurance. It’s not just about automating tasks; it’s about creating intelligent systems that can learn, adapt, and make decisions on their own. Autonomous AI agents are moving beyond just executing commands; they’re becoming active participants throughout the insurance journey. Think underwriting, claims processing, customer service, and even risk management – AI is stepping into all these areas. The result? A more efficient, cost-effective, and ultimately, a higher-quality service for everyone.

Underwriting with Unprecedented Precision

Remember when underwriting felt like a black box? AI agents are changing all that. By tapping into vast datasets and using sophisticated analytical models, these agents can assess risk with a level of detail and speed we’ve never seen before. This means more accurate pricing and policies that are truly customized to your needs. They can analyze everything from your driving habits (thanks to telematics!) to environmental factors, giving a complete picture of risk exposure. For insurers, this means fewer losses, and for you, it means fairer and more appropriate coverage. In fact, a 2025 technical analysis showed that AI has reduced the average underwriting decision time for standard policies from days to just 12.4 minutes, maintaining a 99.3% accuracy rate in risk assessment!. For more complex policies, AI has helped cut processing times by 31% while improving risk assessment accuracy by 43%.

Claims Processing: Speed, Accuracy, and a Touch of Empathy

The claims process can often be a stressful experience, but AI is stepping in to smooth things out. Autonomous AI agents can handle claims from start to finish with remarkable speed and accuracy. They can verify claims, assess damage using image and video analysis, and even process payouts for simpler cases, drastically cutting down on waiting times. This means human adjusters can focus their energy on more complex cases that require that crucial human touch and nuanced judgment, leading to a much better customer experience when you need it most. Some reports suggest that AI could even resolve up to half of all claims through automation by 2030.

Personalized Customer Experiences at Scale. Find out more about autonomous AI agents insurance.

In today’s world, personalization is king. AI agents are perfectly positioned to deliver tailored insurance experiences for each policyholder. By understanding your unique needs, preferences, and even life events, these agents can proactively offer relevant products, adjust your coverage, and provide timely advice. Imagine getting a personalized recommendation for life insurance after welcoming a new child, or receiving a heads-up about potential risks related to changing weather patterns. This kind of individualized attention, delivered at scale, builds stronger customer relationships and fosters loyalty. In fact, studies show that customers who have positive experiences are 80% more likely to renew their policies.

Proactive Risk Management and Prevention

Insurance is evolving from a reactive model to a proactive one, thanks to AI. Autonomous AI agents can actively monitor data streams, identify potential hazards, and alert policyholders *before* problems arise. Think of getting a warning about an impending flood based on weather forecasts and geographical data, or a heads-up to avoid certain routes due to accident data. This shift from reacting to preventing losses benefits both insurers and policyholders by minimizing damage and promoting safety.

The Tech Backbone: What Powers Autonomous Insurance Agents

These intelligent agents aren’t magic; they’re built on some seriously advanced technology. Machine learning, natural language processing (NLP), and sophisticated data analytics form the core of their capabilities, allowing them to perform complex tasks and interact intelligently. The continuous improvement of these underlying technologies is what drives the ongoing evolution and increasing sophistication of AI in the insurance sector.

Machine Learning for Predictive Insights

At the heart of AI agents’ predictive power are machine learning algorithms. These algorithms allow agents to learn from historical data, spot patterns, and make predictions about future events. This is absolutely critical for accurate risk assessment, fraud detection, and developing personalized products. The ability of these models to continuously learn and improve their accuracy over time is a key driver of their transformative potential.

Natural Language Processing for Seamless Interaction. Find out more about AI redefining insurance industry guide.

Natural language processing (NLP) is what allows AI agents to understand and respond to human language, making interactions feel natural and intuitive. This technology enables agents to process written and verbal communications, pull key information from documents, and provide clear explanations. NLP is essential for chatbots, virtual assistants, and for analyzing customer feedback, ensuring that communication is both efficient and effective.

Big Data Analytics for Comprehensive Risk Assessment

The insurance industry is a data goldmine, and big data analytics empowers AI agents to process and analyze these massive datasets, uncovering insights that would be impossible to find manually. This comprehensive analysis leads to a deeper understanding of risk factors, market trends, and customer behavior, informing better decision-making across all aspects of the insurance business. In fact, insurers using advanced analytics have seen up to a 20% improvement in risk assessment accuracy.

The Role of IoT in Real-Time Data Acquisition

The Internet of Things (IoT) is a vital source of real-time data for AI agents. Connected devices like smart home sensors, wearables, and vehicle telematics generate a constant stream of information. This data allows AI agents to monitor conditions, assess behavior, and provide immediate feedback or interventions, further enhancing proactive risk management and personalized services.

Navigating the Roadblocks: Challenges and Ethical Considerations

While the promise of autonomous AI agents is immense, their widespread adoption isn’t without its hurdles. We need to carefully consider critical challenges like data privacy, algorithmic bias, potential job displacement, and the need for clear regulatory frameworks.

Ensuring Data Privacy and Security. Find out more about insurance underwriting AI precision tips.

The reliance on vast amounts of data for AI operations brings significant concerns about privacy and security. Insurers must implement stringent measures to protect sensitive policyholder information from breaches and misuse. Transparency in how data is collected and used, along with robust cybersecurity protocols, will be paramount to maintaining customer trust.

Mitigating Algorithmic Bias and Promoting Fairness

A major ethical challenge is the potential for algorithmic bias. AI systems, trained on historical data, can inadvertently perpetuate or even amplify existing societal biases. It’s crucial to develop and deploy AI agents that are fair, equitable, and free from discriminatory outcomes, ensuring all policyholders are treated justly. For instance, if AI models are trained on data that reflects historical biases in medical studies or loan applications, they could inadvertently perpetuate those inequalities.

Addressing Job Displacement and Workforce Adaptation

The increased automation brought about by AI agents will inevitably change the insurance workforce. While some roles may be reduced, new opportunities will emerge in areas like AI development, data science, and complex problem-solving. A proactive approach to reskilling and upskilling the existing workforce will be essential to manage this transition smoothly.

Establishing Robust Regulatory Frameworks

The rapid advancement of AI necessitates the development of clear and comprehensive regulatory frameworks. These regulations need to address accountability, transparency, and the ethical use of AI in insurance, ensuring the industry operates responsibly and in the best interests of consumers.

The Horizon Beyond 2026: The Evolving Future of Insurance. Find out more about AI claims processing speed accuracy strategies.

The impact of autonomous AI agents on the insurance industry is expected to extend far beyond 2026. As the technology continues to evolve, we can anticipate even more sophisticated applications and a deeper integration of AI into the very fabric of insurance.

Hyper-Personalization and Proactive Engagement

Looking ahead, AI agents will likely enable hyper-personalization, where insurance products and services are dynamically tailored to an individual’s real-time needs and circumstances. This could lead to insurance that adjusts its coverage automatically based on your activities or location, offering a truly seamless and responsive experience.

AI-Driven Product Innovation

The insights generated by AI will also fuel continuous product innovation. Insurers will be able to design novel insurance products that address emerging risks and cater to highly specific market segments, driven by a data-informed understanding of evolving consumer demands and societal changes.

The Rise of Embedded Insurance

Autonomous AI agents will also facilitate the growth of embedded insurance, where coverage is seamlessly integrated into other products and services. For example, a travel booking might automatically include travel insurance, or a new car purchase could come with integrated vehicle protection, all managed by AI.

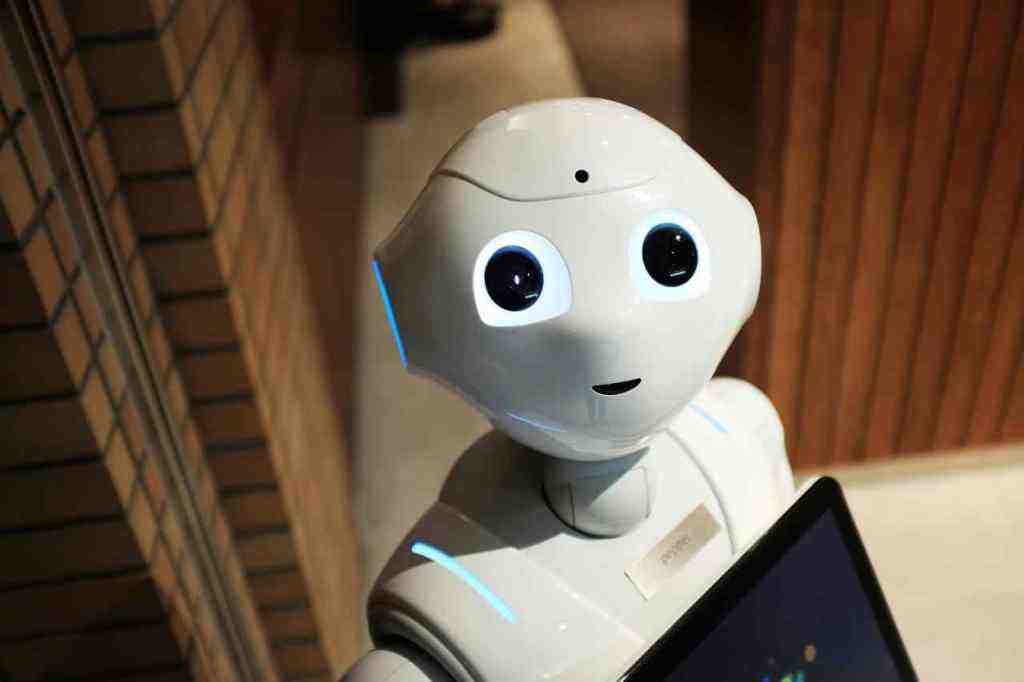

A Collaborative Ecosystem of Human and AI Expertise

The future of insurance will likely involve a collaborative ecosystem where human expertise and AI capabilities work in tandem. AI agents will handle routine tasks and provide data-driven insights, freeing up human professionals to focus on strategic decision-making, complex customer relationships, and ethical oversight. This synergy will create a more efficient, effective, and human-centric insurance industry. As one expert noted, “The future of insurance is not a choice between humans or technology—it’s about merging the strengths of both”. The dawn of autonomous insurance agents is here, and it’s set to transform the industry in profound ways. By embracing AI, insurers can offer more personalized, efficient, and proactive solutions, ultimately creating a better experience for everyone involved. What are your thoughts on the role of AI in insurance? Share your insights in the comments below!