OLED Technology in 2025: Navigating Demand Shifts and Pioneering Innovations

The second quarter of 2025 has unveiled a dynamic and evolving landscape for OLED technology. While the industry experienced modest revenue growth in the first quarter, a confluence of factors, including declining average selling prices (ASPs), is projected to keep full-year revenue growth flat despite healthy increases in unit shipments. This nuanced performance highlights a market adeptly navigating both burgeoning opportunities and persistent challenges, driven by significant technological advancements and shifting consumer demand.

OLED Demand Trends: A Shifting Landscape

The demand for OLED technology is experiencing a multifaceted evolution, with certain sectors showing remarkable resilience while others emerge as significant growth drivers. Understanding these trends is crucial for stakeholders aiming to capitalize on the expanding OLED ecosystem.

Smartphone Segment Resilience Amidst ASP Declines

The smartphone sector, long the largest segment for OLED sales, continues to be a pivotal demand driver. In the first quarter of 2025, unit shipments in this segment saw a modest one percent year-over-year increase. However, revenues remained flat, a clear indicator of prevailing declining ASPs, with smartphone panel prices dropping by two percent year-over-year. Despite these price pressures, the sheer volume of smartphone production ensures a sustained and substantial demand for OLED panels, underscoring the technology’s continued importance in mobile devices.

Gaming and IT Sector Fueling Monitor Growth

A more robust growth narrative is unfolding within the OLED monitor market. Fueled by strong demand from the gaming and creative industries, OLED monitor panel shipments are projected to surge by an impressive sixty-nine percent year-over-year in 2025, building upon an even more aggressive one hundred and thirty-two percent surge experienced in 2024. This upward trajectory signifies OLED monitors transitioning from niche products to mainstream offerings. Key drivers include gamers’ high acceptance of OLED technology, which is encouraging brands to expand their OLED gaming product lines. Furthermore, Korean panel makers are strategically pivoting towards OLED monitors as a response to the slowing OLED TV panel segment, indicating a significant shift in manufacturing focus and investment.

Automotive and Emerging Applications on the Rise

Beyond traditional consumer electronics, the automotive sector is emerging as a significant growth area for OLED technology. The increasing demand for premium quality lighting from luxury car manufacturers, coupled with a rise in collaborations between OLED manufacturers and automakers, is expected to drive faster growth in automotive lighting applications. Innovations in transparent OLEDs are particularly noteworthy, opening new avenues for automotive heads-up displays (HUDs) and architectural installations, effectively transforming windows into dynamic information portals. Emerging categories such as augmented reality (AR) glasses and smartwatches are also contributing to the overall market growth, showcasing the versatility and adaptability of OLED technology across diverse applications.

The Impact of Geopolitical Tensions and Shifting Manufacturing

Geopolitical tensions are also playing a role in shaping the adoption of OLED technology. In a notable strategic shift, some PC manufacturers are reducing their reliance on Chinese-made LCDs, opting instead for South Korean OLED displays for their premium product lines. This move underscores the growing trust and perceived quality associated with OLED panels from established South Korean manufacturers, highlighting a potential realignment in global supply chains driven by both technological preference and geopolitical considerations.

Technological Advancements Shaping the Outlook

The relentless pace of technological innovation is a defining characteristic of the OLED market. These advancements are not only enhancing existing applications but also paving the way for entirely new possibilities.

Fourth-Generation OLED and Enhanced Brightness

Significant strides are being made in OLED technology, with LG Display recently showcasing its fourth-generation OLED, achieving a remarkable maximum brightness of 4,000 nits. This advancement is underpinned by the industry’s first Primary RGB Tandem technology, which ingeniously stacks the three primary colors of light as independent layers. This innovative approach not only enhances brightness but also significantly improves color reproduction, offering a more immersive and three-dimensional visual experience. Samsung is also pushing the boundaries, aiming to release a new generation of QD-OLED panels in 2025 with brightness expected to exceed 3,600 nits, with a target of reaching 4,000 nits by 2026. These developments signal a new era of visual fidelity and performance for OLED displays.

QD-OLED Dominance in the Monitor Segment. Find out more about OLED monitor market growth 2025.

Quantum Dot OLED (QD-OLED) technology is demonstrating strong competitiveness, particularly in the high-end monitor market. QD-OLED’s share of OLED monitor shipments is projected to rise from sixty-eight percent in 2024 to seventy-three percent in 2025. This growth is largely fueled by an increasing number of brands adopting QD-OLED to deliver superior image quality and enhanced refresh rates, catering specifically to gamers and professional users. Advancements such as the introduction of new 27-inch UHD products and high-refresh-rate QHD 500 Hz monitors are key drivers of this adoption, solidifying QD-OLED’s position as a premium display solution.

Breakthroughs in Blue Phosphorescent OLED

A major breakthrough announced at SID Display Week 2025 was the unveiling of a commercially viable blue phosphorescent OLED. For years, blue OLEDs have been considered the Achilles’ heel of the technology, often being less efficient and having shorter lifespans compared to their red and green counterparts. This new development, achieved through hybrid architectures that meticulously balance phosphorescent efficiency with fluorescent stability, promises a fifteen percent power reduction while maintaining current performance standards. This advancement is crucial for improving the overall power consumption and longevity of OLED devices, addressing a long-standing challenge in the industry.

Advancements in Manufacturing Processes

The industry is also actively exploring new manufacturing methods to enhance efficiency and reduce costs. New inkjet and maskless deposition methods are currently in development and early stages of commercialization, with the potential to replace the traditional Fine Metal Mask (FMM) fabrication technique. These innovations could lead to significant breakthroughs in OLED panel manufacturing, potentially lowering production costs and enabling wider adoption of the technology.

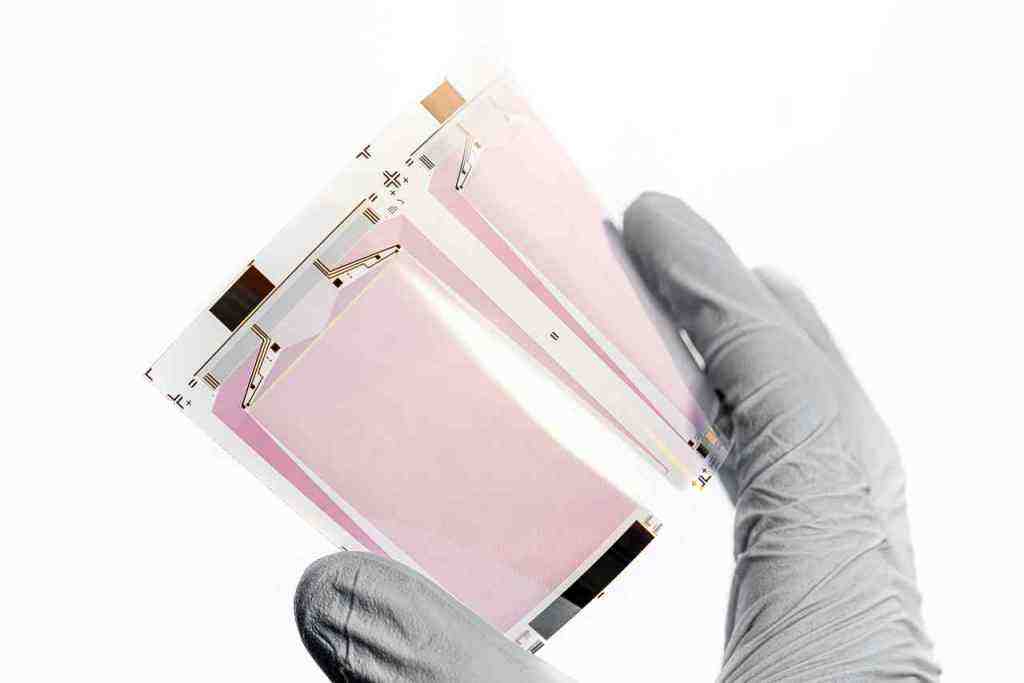

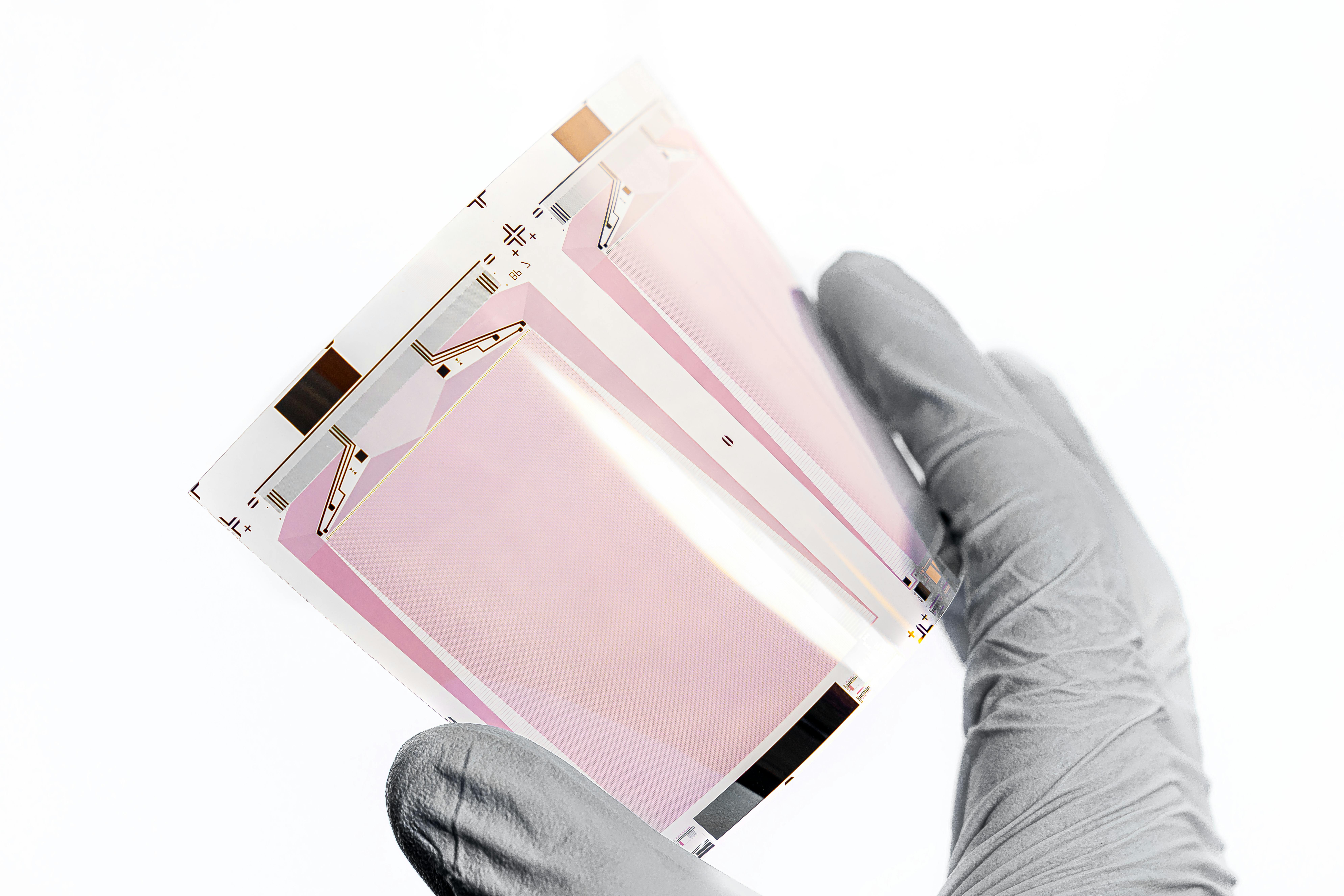

Flexible and Transparent OLEDs: Paving the Way for New Form Factors

The evolution of OLED technology extends significantly to flexible and transparent displays. Rollable and transparent OLEDs are under active development for next-generation devices, enabling unprecedented design possibilities. Transparent OLEDs, in particular, are finding exciting applications in retail, automotive HUDs, and architectural installations, redefining user interaction with displays by seamlessly integrating information into the environment. This focus on flexible and transparent form factors is crucial for unlocking new market segments and driving future growth.

Market Dynamics and Competitive Landscape

The OLED market is characterized by intense competition and strategic maneuvering among key players, alongside persistent challenges that shape its overall trajectory.

Key Players and Market Share

Samsung Display continues to maintain its leadership position, particularly in the critical iPhone supply chain. Following closely are LG Display and the rapidly expanding BOE. Notably, BOE has recently overtaken Samsung Display in the foldable OLED segment, indicating a significant shift in competitive dynamics within this rapidly growing niche. Major players such as Samsung, LG, and BOE Technology are strategically investing heavily in research and development and expanding production capacity to capitalize on the projected market growth across various application segments.

Challenges and Restraints

Despite the overwhelmingly positive outlook, several challenges remain for the OLED industry. The relatively higher cost of production compared to LCDs continues to be a significant barrier to mass adoption in certain price-sensitive segments. Potential supply chain constraints for certain specialized materials also present ongoing concerns. Additionally, while burn-in concerns are steadily improving with technological advancements, they still remain a consideration for some consumers, particularly in applications with static on-screen elements. The industry is also facing headwinds from declining average selling prices (ASPs), which are currently keeping full-year revenue growth flat, necessitating a focus on innovation and market expansion to drive profitability.

Sustainability Initiatives Gaining Traction

Sustainability is increasingly becoming a pivotal aspect of OLED technology development and marketing. LG Electronics, for instance, has consistently received globally recognized eco-certifications for its 2025 OLED TVs, including “Reducing CO2” and “Measured CO2” certifications from the Carbon Trust for the fifth consecutive year. These certifications highlight LG’s commitment to environmental responsibility, evidenced by advancements in lighter materials, reduced plastic usage, and increased recycled plastic content in their products. For example, LG’s 65-inch OLED evo TV is twenty percent lighter than conventional LCD TVs and utilizes sixty percent less plastic. The company anticipates reducing plastic consumption by approximately 16,000 tons in 2025 compared to an equivalent number of LCD TVs, demonstrating a tangible commitment to reducing its environmental footprint.

Future Outlook and Projections. Find out more about explore fourth generation OLED technology advancements.

The future of OLED technology appears exceptionally bright, with multiple market reports projecting significant growth and the emergence of transformative new applications.

Market Growth Projections

The global OLED market is poised for substantial growth in the coming years. According to a 2025 MarketsandMarkets report, the market is projected to grow at a Compound Annual Growth Rate (CAGR) of 17.2% from 2025 to 2030, reaching an estimated $75 billion by 2030. Other industry reports project the OLED market to be valued at USD 31.60 billion in 2025 and forecast it to reach USD 50.57 billion by 2030, advancing at a 9.86% CAGR. The broader OLED display market is anticipated to reach nearly USD 133.15 billion by 2032, with a CAGR of 13.9% from 2025 to 2032. These projections underscore the technology’s robust expansion across various sectors.

Emerging Technologies and Applications

The future of OLED technology is being shaped by ongoing research and development focused on further enhancing performance, reducing costs, and exploring novel applications. Innovations in areas such as solution-processed OLED for more accessible large-panel manufacturing and the integration of OLEDs with artificial intelligence (AI) for advanced wearable health monitoring are poised to redefine the display landscape. The development of OLEDoS (OLED-on-Silicon) for microdisplays also presents significant opportunities, with leading companies like Samsung Display and LG Display already showcasing high-brightness OLEDoS innovations, signaling a strong push into next-generation display form factors.

The Competitive Edge of OLED

As the technology matures, OLED continues to set benchmarks for display quality, offering inherent advantages in contrast, color accuracy, and design flexibility that are exceptionally difficult for competing technologies like LCD to match. While advancements in Mini-LED and Micro-LED technologies continue to emerge, OLED remains a dominant force, particularly in premium segments, and is poised for sustained growth across a diverse range of applications. The continuous innovation cycle, driven by intense competition among major players, is creating a positive feedback loop that stimulates further market growth and makes OLED technology increasingly accessible to consumers worldwide.

OLED Technology: Core Advantages and Evolution

The enduring appeal and rapid advancement of OLED technology stem from a combination of fundamental advantages and a consistent evolution driven by innovation.

Unparalleled Contrast and Color Accuracy

OLED displays are universally celebrated for their infinite contrast ratio, a direct result of individual pixel control that allows for true black levels. This capability is absolutely crucial for High Dynamic Range (HDR) content, enabling the delivery of vibrant and remarkably accurate colors that consistently cover 100% of the DCI-P3 color gamut. This level of visual fidelity is a primary reason for OLED’s dominance in premium display markets.

Energy Efficiency and Response Time

OLEDs offer superior energy efficiency, particularly when displaying dark scenes, as individual pixels only consume power when they are actively emitting light. Furthermore, their exceptionally fast response times, as low as 0.1ms, make them ideally suited for demanding applications such as gaming and high-speed video content, significantly outperforming traditional LCDs in motion handling and reducing motion blur.

Design Flexibility and Form Factor Innovation

The inherent ability to manufacture OLED panels on flexible substrates has unlocked a vast array of new possibilities in device design. This flexibility enables the creation of curved, foldable, and even rollable displays, pushing the boundaries of what is aesthetically and functionally possible in consumer electronics. This inherent flexibility is a key differentiator, allowing for more innovative and user-centric product designs that cater to evolving consumer preferences.

Evolution of OLED Generations. Find out more about discover QD-OLED monitor shipments 2025.

The journey of OLED technology is marked by continuous generational improvements, each iteration bringing significant enhancements. From the early prototypes to the current fourth-generation advancements, each phase has introduced substantial improvements in brightness, energy efficiency, and overall performance. Key developments include the introduction of Quantum Dot OLED (QD-OLED), significant improvements in burn-in resistance, and ongoing exploration of new pixel architectures and backplane advancements, all contributing to OLED’s sustained competitive edge.

The Expanding Ecosystem of OLED Applications

The versatility of OLED technology is driving its adoption across an increasingly diverse range of applications, extending far beyond its initial stronghold in televisions.

Dominance in Premium Television and Home Entertainment

OLED televisions continue to unequivocally dominate the premium TV market. Manufacturers such as LG, Sony, and Philips are consistently offering advanced features like AI upscaling and high refresh rates specifically for gaming. The rapid proliferation of OLED TVs, driven by significant cost declines in large-area panels, remains a primary market driver, making this premium technology more accessible to a wider consumer base.

Transforming the IT Sector: Monitors and Laptops

The IT sector is witnessing a substantial surge in OLED adoption, particularly in the segments of monitors and notebooks. The demand for superior image quality and enhanced visual experiences is unequivocally fueling the growth of the OLED monitor market. Advancements in QD-OLED technology, in particular, are driving competitiveness in the high-end segment, offering professionals and gamers alike an unparalleled visual experience.

Automotive and Wearable Electronics Integration

OLED technology is increasingly being integrated into automotive displays, offering unparalleled design flexibility for curved and transparent screens that enhance both aesthetics and functionality. In the realm of wearable electronics, OLEDs are revolutionizing devices by enabling ultra-thin, flexible, and energy-efficient designs that are critical for advanced health monitoring and interactive applications. This integration signifies OLED’s growing importance in the Internet of Things (IoT) ecosystem.

Emerging Applications in Lighting and Beyond

Beyond its dominant role in displays, OLED technology is also making significant inroads into general lighting applications, offering substantial energy efficiency and environmental benefits. Research is actively exploring the integration of OLEDs into textiles and other novel substrates, hinting at a future where displays are seamlessly embedded into everyday materials and environments, blurring the lines between technology and the physical world.

Sustainability and Environmental Responsibility

As the technology matures, a strong emphasis is being placed on sustainability and reducing the environmental footprint of OLED production and usage.

LG’s Commitment to Eco-Conscious Design

LG Electronics is demonstrably at the forefront of sustainability within the OLED market. The company consistently receives globally recognized eco-certifications for its OLED TVs, underscoring its commitment to environmentally conscious design. This dedication is evident in its use of lighter materials, reduced plastic usage, and increased incorporation of recycled plastics in its manufacturing processes. LG’s proactive approach sets a benchmark for the industry.

Reduced Environmental Footprint. Find out more about understand blue phosphorescent OLED breakthrough.

OLED TVs, due to their self-emissive technology, inherently eliminate the need for a backlight unit. This simplification reduces component count and overall material usage, leading to a smaller environmental footprint. LG’s efforts are projected to significantly reduce plastic consumption and carbon emissions in 2025 compared to equivalent LCD TV production. For instance, the company anticipates reducing plastic consumption by approximately 16,000 tons and lowering carbon emissions by 84,000 tons, showcasing a tangible commitment to environmental stewardship.

Energy Efficiency and Material Innovation

OLEDs are inherently more energy-efficient than LCDs, particularly when displaying darker content, as only the active pixels consume power. Furthermore, the industry is actively exploring the use of eco-friendly materials, such as biodegradable substrates, to further reduce the environmental impact of OLED manufacturing. OLEDWorks highlights that their OLED lighting panels are exceptionally sustainable and energy-efficient, contributing to reduced power and fuel consumption and lower greenhouse gas emissions, aligning with global sustainability goals.

Challenges and Future Growth Catalysts

While the future of OLED is bright, addressing existing challenges and leveraging emerging growth catalysts will be crucial for sustained market expansion.

Addressing Cost and Durability Concerns

While OLED technology offers superior performance, challenges related to higher production costs compared to LCDs and potential durability concerns, such as image retention or “burn-in,” persist. However, continuous innovation in manufacturing processes and material science is actively aimed at mitigating these issues and making OLED technology more accessible and reliable for a broader range of applications and consumers.

The Role of New Form Factors in Driving Demand

The adoption of newer OLED-driven form factors, such as foldable smartphones, rollable displays, and flexible wearables, is crucial for revitalizing revenue growth and reaching mainstream markets. These innovative designs not only capture consumer interest with their novelty but also drive further technological advancements in material science and manufacturing processes, creating a virtuous cycle of innovation and demand.

Technological Roadmaps and Industry Investments

The future growth of the OLED market is strongly underpinned by significant investments in research and development and production capacity by key industry players like Samsung Display and LG Display. The ongoing development of advanced technologies, such as QD-OLED and next-generation blue phosphorescent emitters, alongside continuous improvements in manufacturing processes, will continue to shape the industry’s trajectory and maintain its competitive edge.

The Competitive Imperative for Innovation

The competitive landscape in the display market remains intensely fierce. Manufacturers are constantly striving to enhance key features such as refresh rates, response times, and HDR capabilities. This continuous innovation cycle is absolutely essential for capturing market share, driving the broader adoption of OLED technology across various applications, and ultimately delivering superior visual experiences to consumers.

Conclusion: A Bright Future for OLED Technology

The OLED market in 2025 is characterized by robust demand trends, particularly in the gaming and IT sectors, coupled with significant technological advancements that are consistently pushing the boundaries of display performance. While challenges related to ASPs and production costs remain, the industry’s unwavering commitment to innovation, sustainability, and the exploration of new applications points towards a future of sustained growth and continued evolution for OLED technology. The ongoing advancements in brightness, color accuracy, energy efficiency, and form factor flexibility ensure that OLED will remain a leading display technology, shaping the visual experiences of consumers across a wide array of devices and applications for years to come.