4 Bills You Don’t Have To Pay If You’re Rich

Introduction

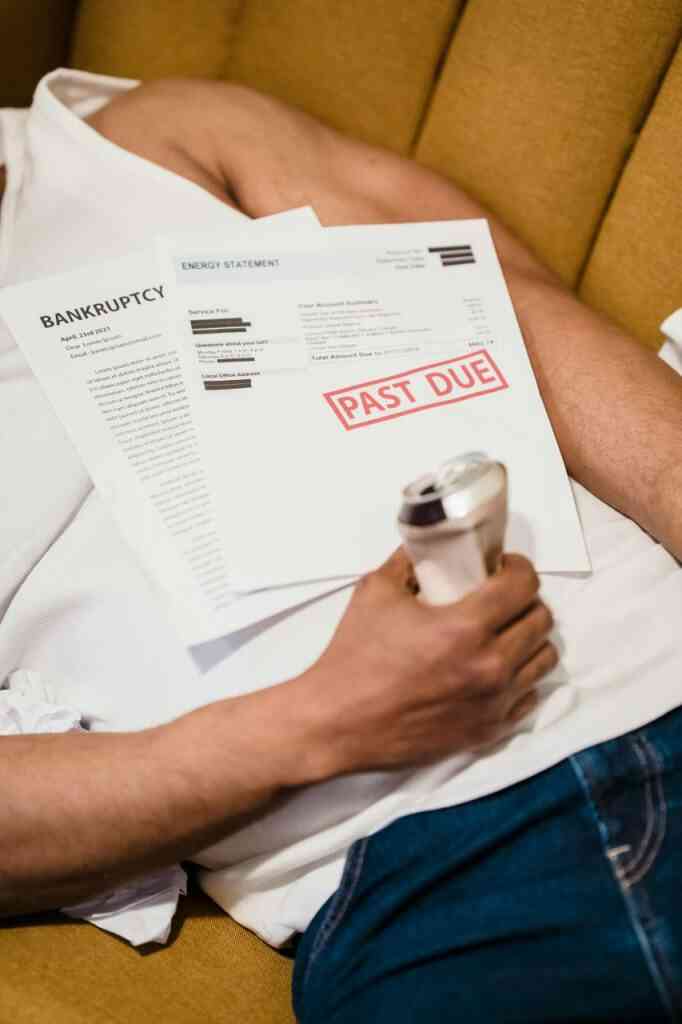

Wealth, an alluring prospect often associated with lavish lifestyles and financial freedom, extends beyond conspicuous consumption. It offers a unique vantage point from which certain bills, burdensome to the average person, become relics of the past. This article delves into four such bills that wealthy individuals generally don’t have to grapple with, providing insights into the financial advantages that accompany affluence.

1. Student Loan Payments: Breaking the Chains of Debt

The weight of student loan debt has become a defining characteristic of the modern economy, with millions of individuals burdened by monthly payments that can stretch for decades. The average student loan payment in the United States hovers around $503, a hefty sum that can significantly impact financial stability and life choices. However, for the wealthy, this burden is often nonexistent.

Wealthy families frequently have the means to pay for their children’s education upfront, shielding them from the weight of student loan debt. This financial privilege opens up a world of possibilities, allowing them to pursue higher education without the lingering fear of prolonged debt repayment. Scholarships and trust funds further contribute to this advantage, providing alternative avenues for funding education and eliminating the need for loans.

2. Car Payments: A Choice Between Ownership and Convenience

The allure of a new car can be intoxicating, but the reality of monthly car payments can quickly dampen the excitement. The average new car payment in the United States exceeds $700, while used car payments hover around $500. For many, these payments represent a significant portion of their monthly budget, a constant reminder of the financial burden of car ownership.

Wealthy individuals, however, often choose a different path. They may opt to purchase vehicles with cash, avoiding the need for monthly payments and the accumulation of interest. This strategy can save them substantial sums over time, particularly when considering the high-interest rates often associated with car loans. Additionally, wealthy individuals may prioritize owning their vehicles outright, granting them the freedom to sell or trade without the constraints of outstanding loans.

3. Credit Card Finance Charges: Avoiding the Debt Trap

Credit cards, while convenient, can be a double-edged sword. While they offer flexibility and purchasing power, they also come with the risk of accumulating debt and incurring hefty finance charges. The average interest rate on a credit card exceeds 20%, a staggering figure that can quickly turn small balances into overwhelming debts.

Wealthy individuals, however, often have the discipline and financial resources to pay their credit card balances in full each month, effectively avoiding finance charges altogether. This prudent financial behavior not only saves them money but also helps them maintain a良好的信用评分, opening doors to favorable loan terms and other financial advantages.

4. Mortgage Payments: The Path to Homeownership Without Debt

For most people, a mortgage is a necessary evil, a long-term commitment that represents their largest monthly expense. The average monthly mortgage payment in the United States exceeds $1,000, a substantial sum that can strain household budgets and limit financial flexibility.

Wealthy individuals, however, often have the financial means to purchase homes outright, eliminating the need for a mortgage. This strategic move can save them a significant amount of money in interest payments over the life of the loan, which can easily reach hundreds of thousands of dollars. Moreover, owning a home free and clear provides peace of mind and the freedom to customize and renovate without the constraints of a mortgage lender.

Conclusion: The Privileges of Wealth

While wealth does not guarantee happiness or fulfillment, it undoubtedly offers a number of financial advantages. By eliminating certain bills and expenses, wealthy individuals can save money, reduce their debt, and increase their financial security. This allows them to live more comfortably, pursue their financial goals more easily, and enjoy the peace of mind that comes with financial stability.